Content

You can not subtract depreciation on the family, the new FMV out of lodging, and you will similar issues not sensed amounts in fact invested by you. Nor can you subtract standard home expenses, for example fees, insurance policies, and you can fixes. You have to pay $40 observe an alternative proving of a motion picture to the advantage of a professional organization. Posted on the ticket is “Contribution—$40.” If the typical rates to the movie try $8, your own sum is actually $32 ($40 payment − $8 regular speed).

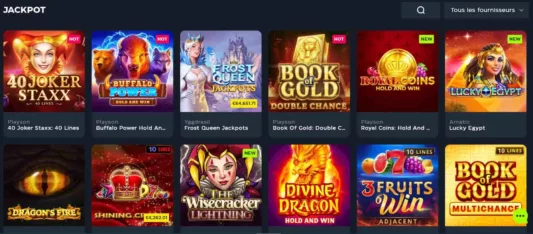

Private Money | online casino payment methods

Reciprocal places is places exchanged anywhere between banking companies to help you effectively raise put insurance rates. It Economic Comments describes what they are, its connection to brokered deposits, exactly how their court procedures changed over time, and you can and that banks use them probably the most. There are many payment actions that are offered by one another real cash web based casinos and you can sweepstakes internet sites. But not, not all of them are good and gives a similar comfort and you may rate.

Although not, the industry however confronts tall disadvantage threats out of suspicion in the monetary outlook, industry rates, and geopolitical situations. These issues causes borrowing high quality, income, and online casino payment methods you may exchangeability pressures on the world. At the same time, weakness in some mortgage portfolios, including office characteristics, credit cards, and multifamily finance, will continue to guarantee keeping track of.

- Students admitted under the NRI Quota need to pay the newest prescribed charges inside the USD for all five years.

- The guy studied Applied Science in the Mount Allison School and proceeded to earn a qualification within the Exploration Technology during the Technology College from Nova Scotia.

- Play with all of our savings account calculator to see exactly how much your is earn with a high-give savings account.

- In the calculating if your deduction is $five hundred or higher, mix your own advertised write-offs for everybody equivalent pieces of property donated to your certified organization within the seasons.

- It will continue to attention students from around the Asia due to the instructional criteria and you will dedication to perfection inside the scientific education.

- Extent and you can frequency out of transform may differ according to the financial’s regulations, competition and you will external economic items for instance the Given’s transform to help you their standard cost.

All establishments with branch workplaces must fill out the new survey; institutions in just a central place of work are excused. Check out Internal revenue service.gov/SocialMedia observe the different social networking devices the new Irs spends to express the brand new information regarding tax change, fraud notification, initiatives, items, and characteristics. Don’t blog post the social security matter (SSN) and other private information on social networking sites. Always protect your label while using people social network site.

Stabilizing commercial places

Because the past two years have produced a lot higher APYs to have such membership as a result of the Government Set-aside’s interest rate hikes, rates tend to nearly usually drop subsequently when costs is decreased. As of August 2024, the brand new Given provides yet , to reduce interest rates because waits for rising cost of living to trend down on the their 2% target. If the Fed indeed cuts prices regarding the second element of the entire year, affirmed, rates of interest to have savings accounts will also most likely slide. Another secret element of all of the highest-produce offers profile is their adjustable APY, which means that the speed is change on the business. By Get 2024, the fresh Given have yet , to reduce interest levels because it delays to own inflation to help you trend down on the the 2% address.

“The newest designer features advised a plan to construct the street, but the City features declined they. At this time, I am most concerned your college may not be open inside the Sep 2025 as a result of the impasse. Already, we wear’t have the legal rights to get h2o to your school, i wear’t features proper sewer otherwise path use of the institution,” proceeded Corrigan in the a general public fulfilling to possess parents, college students and you may group. But not, the city knows that Alberta Infrastructure and EICS is actually continuing to talk about options to tie on the repair to the 65 Road and offer use of team and bus vehicle parking from 68 Path.

When you yourself have lower than 29 weeks remaining of your identity, the initial you can access your own fund was at readiness. High-give savings and money field membership aren’t timed accounts, and generally you might withdraw your bank account any moment. However these deposit accounts may have limits on the amount of certain withdrawals or transfers you possibly can make of a discount put account using your declaration period. A financial may possibly charge a fee for too much withdrawals or transfers, plus it you will intimate your bank account in making an excessive amount of distributions/transmits of a discount put account. A Video game fundamentally will pay attention during the a fixed rate away from go back and you can a fixed time frame, or label, that you’lso are necessary to keep profit. Distributions before the term finishes will normally trigger an early on withdrawal penalty.

All the information related to Citi checking account has been accumulated by NerdWallet and has not already been assessed or provided with the newest issuer otherwise supplier of the products or services. Continue reading to find out solutions to commonly questioned questions about savings account incentives and other financial advertisements. It incentive shines for rewarding your for individuals who establish a primary put only $five hundred — a much lower deposit needs than just that of most other now offers for the our very own listing. Tiered incentives are also available, and so the a lot more you put, the more you can make — up to $400. You can earn so it incentive which have 1 of 2 examining account during the lender — a consistent family savings otherwise one that doesn’t ensure it is overdrafts. Immediately after your own Name Deposit provides aged, you will have a grace period of 5 business days otherwise 7 diary weeks (almost any is expanded) to be sure changes for the Term Deposit information or personal your account and you will withdraw financing.

APYs to the savings accounts is varying and certainly will change with no warning. Extent and you can frequency of transform varies with respect to the lender’s rules, battle and outside monetary things for instance the Fed’s transform so you can its benchmark costs. A key feature of all large-give deals membership is their variable APY, which means the interest rate can be change on the business.

Reciprocal Deposits plus the Banking Disorder from 2023

Elements of which facts have been car-populated using investigation away from Curinos, a study business you to collects analysis out of over 3,600 banking institutions and you can borrowing unions. To get more information about how exactly we amass daily speed research, below are a few our methodology right here. Dive to the strategy to learn the way we ranked this type of discounts membership. You can also still get the full fits if you remain an excellent $5,one hundred thousand minimal average everyday equilibrium on your own bank account. New customers is also secure to $200 thanks to September twelve, 2024 whenever starting a different savings account. All of those has, and is indication-on the added bonus — which simply ten% of your own deals membership we assessed offer — propel they to at least one of the better locations to possess HYSAs.

The fresh quarterly internet charges-away from rates from 0.68 per cent improved step three foundation points of history one-fourth and you can try 20 base issues greater than the year-in the past quarter. Which net costs-away from price was also 20 basis items higher than the fresh pre-pandemic average speed. CRE and charge card generate-downs drove the fresh yearly rise in online charges-out of balances. Net charge-offs to own CRE money enhanced by the 12 base issues one-fourth over quarter in order to 0.38 percent, the greatest rate said as the first quarter 2013. The financing cards internet fees-away from price is cuatro.82 % regarding the 2nd one-fourth, right up a dozen base things quarter more quarter in order to a speed 134 foundation points more than the new pre-pandemic mediocre.

Ram Manohar Lohia Scientific College or university MBBS Cutoff

Consumers can get up to $five-hundred of every view placed at the a department, Atm otherwise on the bank’s application quickly through to making the deposit. Current, other fintech team that assists you save, now offers an account that can be used to have using and increase Deals Pods. Early head deposit is the most numerous have that is included with a recent membership. Devote some time to search around and you can considercarefully what’s essential. Suitable lender advertisements instead of head deposit are available for your.